Key Points

- The mandate of a financial literacy course for high school graduation has made Florida the largest state to adopt this requirement.

- The new law will require students entering ninth grade in 2023-2024 to take a half-credit course in personal finance before graduation.

- Personal finance education is a growing trend in schools, and the pandemic has highlighted the importance of teaching solid financial habits.

Florida Mandates Personal Finance Education for High School Students

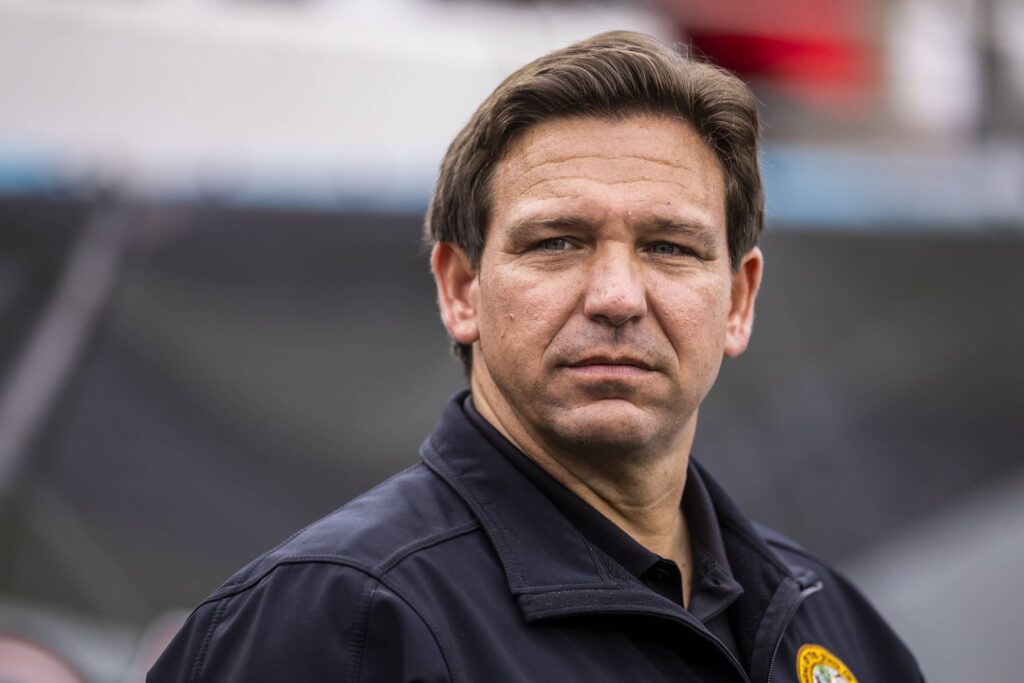

Governor Ron DeSantis signed SB 1054 into law on Tuesday, March 1st, 2021, making Florida the largest state to mandate a financial literacy course for high school graduation. This historic legislation has significant implications for the future financial well-being of Florida students.

What the Law Requires

Florida’s new law mandates that all high school students going into the ninth grade in the 2023-2024 school year must complete a half-credit course in personal finance before graduation. The curriculum will encompass important financial topics such as money management, debt, balancing a checkbook, and investing.

In a recent press event, Governor DeSantis emphasized the significance of the new law in providing students with a strong financial foundation that is relevant to all career paths. According to Rep. Demi Busatta Cabrera, a Republican and one of the bill’s main sponsors, every student deserves to be outfitted with the expertise and knowledge to achieve financial success in our society, whether they attend college, pursue a trade or apprenticeship, or pursue a career in the arts or the military.

A Growing Trend in Personal Finance Education

Several states are joining Florida in their efforts to provide personal finance education to their students. Based on the bill tracker maintained by Next Gen Personal Finance, there are currently 54 personal finance education bills pending in 26 states. Of these states, 11 have already adopted the gold standard of education by requiring students to complete a stand-alone personal finance course to graduate, including Florida. This trend highlights the growing recognition of the importance of equipping students with the expertise and skills necessary to navigate the complexities of finance. Other states have various proposals for incorporating personal finance education into their curricula. For example, a bill proposed in Arizona suggests that a personal finance course can fulfill a math course requirement, while Tennessee proposes to mandate personal finance courses for middle school students.

As Yanely Espinal, director of educational outreach at Next Gen Personal Finance, a nonprofit, notes, “The world of money is changing so fast, if we don’t help our students keep up, the next generation is going to repeat cycles of a lack of financial literacy.” The pandemic has only highlighted the importance of teaching solid financial habits, and the trend of personal finance education in schools shows no signs of slowing down.