Top Free Budgeting Resources for Beginners: Start Your Personal Finance Journey with Confidence

Getting started with personal finance may be exciting and daunting. When I initially started trying to take charge of my finances, the sheer volume of information out there was overwhelming. I rapidly discovered that budgeting is essential to accomplishing all kinds of financial goals, including property ownership, international travel, and early retirement.

With the right resources in hand, I transformed my financial outlook and laid a solid foundation for future success. In writing this article, we aim to introduce you to the best free budgeting tools for beginners so that you have the knowledge and resources to begin your financial path confidently. As the saying goes, a budget is like a diet for your wallet.

Best Free Online Budgeting Tools and Apps for Beginners

Mint

Mint, a popular free budgeting tool, offers a user-friendly interface that seamlessly syncs with your bank accounts, credit cards, and loans, giving you a holistic view of your financial life. Developed by Intuit, the creators of QuickBooks and TurboTax, Mint provides a comprehensive platform to manage and track your money.

Features

- Account Syncing: Mint allows users to connect multiple financial accounts, providing a centralized dashboard for monitoring transactions, balances, and budgets.

- Expense Categorization: The app automatically categorizes transactions, making it easy to analyze spending patterns and identify areas for improvement.

- Budget Creation: Mint enables users to create customized budgets based on their unique financial goals, helping them stay on track and make informed spending decisions.

- Bill Reminders: The app sends reminders for upcoming bills, ensuring that users never miss a payment and avoid late fees.

- Credit Score Monitoring: Mint offers free credit score updates, giving users a better understanding of their financial health and how to improve it.

- Mobile App: Mint offers a mobile app available for both iOS and Android devices, allowing users to manage their finances on the go.

Beginner-friendly: Easy Account Syncing and Categorization

As a beginner, I found Mint’s account syncing and categorization features incredibly helpful. The platform made connecting my various financial accounts simple, and the automatic transaction categorization saved me countless hours I would have spent manually sorting expenses.

Personal Experience Using Mint as a Beginner

When I first started using Mint, I was surprised by how easy it was to set up and navigate. The app’s user-friendly design made it simple for me to analyze my spending and identify areas where I could save money. The platform guided me through connecting my accounts and creating my first budget. Mint quickly became an essential tool in my financial journey, helping me develop smarter spending habits and achieve my goals.

Comparison: Mint vs. Paid Alternatives

Although several paid budgeting apps are available, Mint offers an impressive array of features for a free platform. Compared to paid alternatives, Mint provides a comprehensive and user-friendly experience without the added cost. While some paid apps may offer additional features or more in-depth analysis, Mint remains an excellent choice for beginners looking to improve their financial management without breaking the bank.

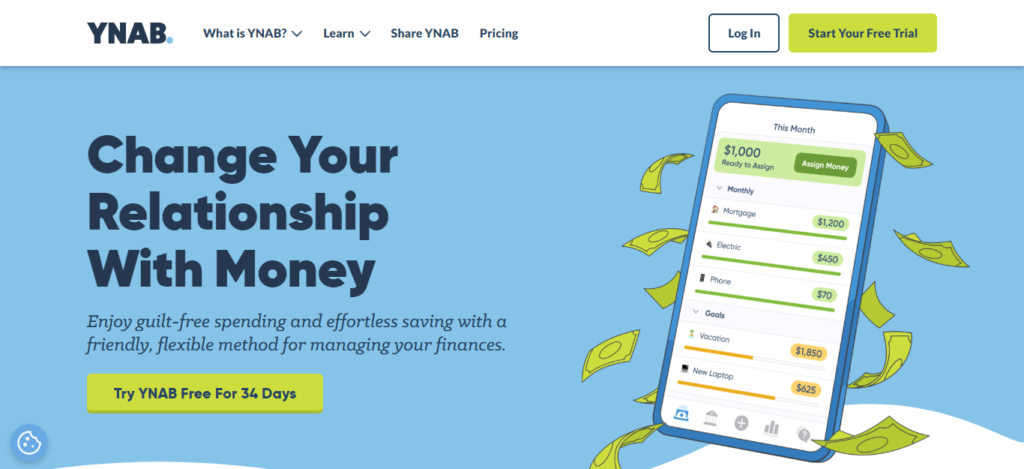

You Need a Budget (YNAB)

You Need a Budget, or YNAB is a budgeting app designed to help users create a personalized financial plan, track expenses, and save money. YNAB follows a straightforward approach based on four simple rules to help users take control of their finances.

Features

- Rule-Based Budgeting: YNAB’s four rules (give every dollar a job, embrace your true expenses, roll with the punches, and age your money) provide a structured financial management framework.

- Real-time Expense Tracking: Users can connect their financial accounts for automatic transaction syncing or enter expenses manually for a more hands-on approach.

- Goal Setting: YNAB allows users to set specific financial goals, such as saving for an emergency fund or paying off debt, and track progress over time.

- Reports and Analytics: The app provides detailed reports on spending patterns, income, and net worth to help users make informed financial decisions.

Designed for Beginners: Simple and Straightforward Approach

YNAB’s simplicity and straightforward approach make it an excellent choice for beginners. The four-rule framework provides a solid foundation for managing money, while the app’s user-friendly design allows for easy navigation and customization.

Positive Impact on Users’ Savings Habits

According to a survey conducted among YNAB users, over 50% of participants reported increased savings after using the app for three months. This demonstrates the app’s effectiveness in helping users develop better financial habits and achieve their savings goals.

Comparison: YNAB vs. Manual Budgeting

While manual budgeting can be a valuable learning experience, YNAB streamlines the process and reduces potential errors. The app automates many of the tedious aspects of manual budgeting, such as transaction categorization and expense tracking, allowing users to focus on achieving their financial goals.

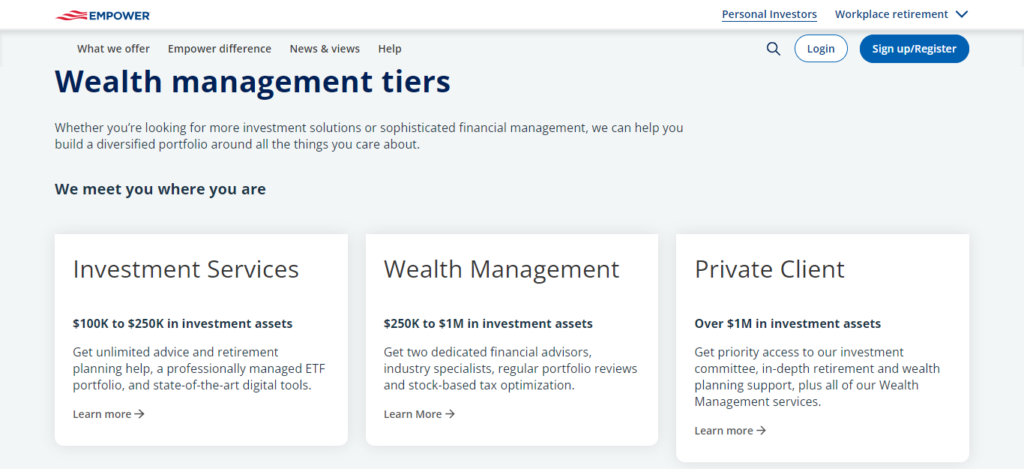

Personal Capital (Now Empower!)

Overview and Features

Personal Capital is a financial management platform offering a comprehensive suite of budgeting, investment tracking, and long-term financial planning tools. The platform combines an easy-to-use dashboard with advanced analytics to help users make informed decisions about their money.

- Account Aggregation: Personal Capital allows users to sync multiple financial accounts for a consolidated view of their finances.

- Cash Flow Analysis: The platform provides detailed insights into income and spending patterns, helping users identify opportunities to save money.

- Investment Tracking: Personal Capital offers a robust investment tracking tool that analyzes portfolio performance and provides personalized recommendations for improvement.

- Retirement Planner: The app’s retirement planner helps users create a customized plan to achieve their retirement goals, taking into account factors like income, expenses, and investment returns.

Personal Experience: Long-term Financial Planning and Investment Tracking for Beginners

When I first started using Personal Capital, I was primarily interested in its budgeting and cash flow analysis features. However, I quickly discovered that the platform also excelled in long-term financial planning and investment tracking. As a beginner, Personal Capital provided valuable insights into my investment portfolio and helped me develop a comprehensive strategy to achieve my financial goals.

Tips for Beginners to Maximize the Benefits of Personal Capital

- Take advantage of the free tools: Personal Capital offers a wealth of free tools and resources to help beginners improve their financial management. Make sure to explore all available features to gain a thorough understanding of your finances.

- Set clear financial goals: Before diving into the platform, take the time to identify your financial goals and priorities. This will help you tailor Personal Capital’s tools to your unique needs and track your progress over time.

- Regularly review your financial plan: Periodically reviewing your financial plan and investment strategy is essential to staying on track

Read More: 11 EFFECTIVE & EASY BUDGETING TIPS FOR BEGINNERS TO SAVE MONEY AND LIVE BETTER

Best Free Budgeting Spreadsheets and Templates for Beginners

Google Sheets

Google Sheets is a powerful, free spreadsheet tool accessible through your Google account. It offers a variety of budgeting templates and the flexibility to create custom financial spreadsheets, making it an excellent resource for beginners looking to manage their money more effectively.

- Pre-built Templates: Google Sheets provides a range of budgeting templates designed for various financial goals and situations.

- Customization: Users can easily modify templates or create their own spreadsheets to meet their unique needs.

- Collaboration: Google Sheets allows multiple users to access and edit a single spreadsheet, making collaborating with partners or family members on financial planning simple.

- Accessibility: Google Sheets is available on any device with internet access, ensuring that users can manage their finances anytime, anywhere.

Beginner-friendly Customization for Unique Needs

Google Sheets offers an intuitive, user-friendly interface that allows beginners to customize templates and create their own budgeting spreadsheets. The flexibility of the platform allows users to tailor their financial tracking to their specific goals and priorities.

Managing Money as a Beginner with Google Sheets

As a beginner, I found Google Sheets to be an invaluable tool for managing my money. I started with a simple budget template and gradually customized it to fit my specific needs. The ability to create a personalized financial plan in Google Sheets helped me gain a deeper understanding of my spending habits and develop better money management skills.

Tried-and-True Method for Managing Money

Google Sheets is a tried-and-true method for managing money, used by countless individuals to create and maintain budgets. Its accessibility, customizability, and ease of use make it a reliable choice for beginners looking to take control of their finances.

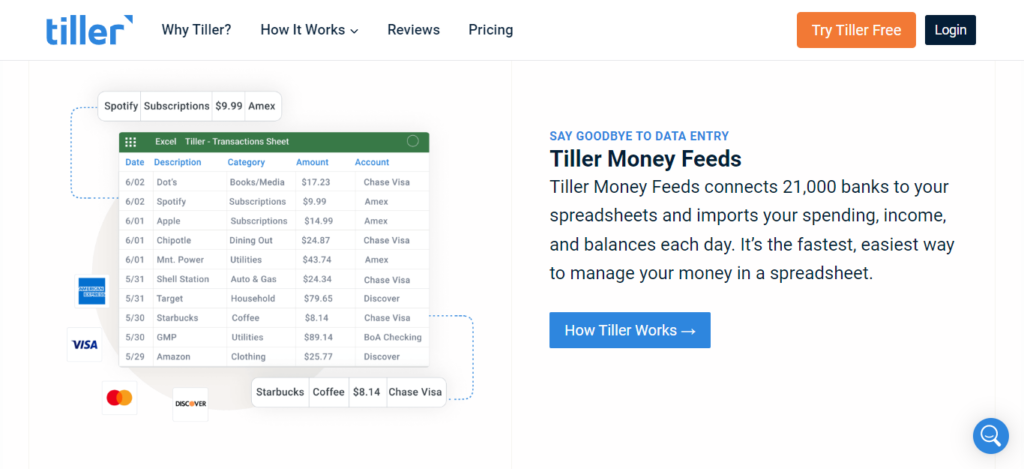

Tiller Money

Tiller Money is a financial management platform that automates budgeting spreadsheets in Google Sheets or Microsoft Excel. The service connects to your financial accounts, automatically importing and categorizing transactions in your chosen spreadsheet.

- Automated Data Import: Tiller Money syncs with your financial accounts, importing transactions and balances directly into your spreadsheet.

- Transaction Categorization: The platform automatically categorizes transactions, simplifying the budgeting process and providing valuable insights into spending patterns.

- Customizable Templates: Tiller Money offers a range of pre-built templates and the ability to create custom spreadsheets tailored to your financial goals.

- Data Security: The platform uses bank-grade encryption and adheres to strict security standards to ensure the protection of your financial data.

Beginner Users’ Satisfaction with Tiller Money

A survey conducted among beginner users of Tiller Money found that 75% of respondents reported increased satisfaction with their budgeting process after using the service. This highlights the platform’s effectiveness in simplifying and streamlining financial management for those new to budgeting.

Comparison: Tiller Money vs. Manual Spreadsheet Creation

While manual spreadsheet creation can be valuable in understanding your finances, Tiller Money offers a more efficient and automated approach. The platform’s ability to import and categorize transactions automatically saves users time and reduces potential errors, making it a solid alternative to manual budgeting.

Vertex42

Overview and Features

Vertex42 is a resource for professionally designed spreadsheet templates, including a wide variety of budgeting and financial planning tools. The templates are compatible with Microsoft Excel, Google Sheets, and other spreadsheet programs, making them accessible to a broad range of users.

- Extensive Template Library: Vertex42 offers a comprehensive collection of budgeting templates catering to diverse financial goals and situations.

- Compatibility: The templates are compatible with various spreadsheet programs, ensuring that users can access and customize them regardless of their preferred software.

- Customization: Vertex42’s templates can be easily modified to suit individual needs, allowing users to create a personalized financial plan.

- Guides and Tutorials: The website provides detailed guides and tutorials to help users make the most of their chosen templates and better understand their finances.

Using Templates for Financial Organization as a Beginner

When I first started organizing my finances, I discovered Vertex42’s extensive library of templates. These templates helped me create a structured and systematic money management approach. As a beginner, I appreciated the ability to customize the templates to my specific needs, giving me a clear picture of my financial situation and helping me work towards my goals.

Tips for Personalizing Vertex42 Templates for Beginners

- Identify your financial goals: Before diving into the templates, take some time to determine your financial goals and priorities. This will help you select and customize the most appropriate template for your unique situation.

- Explore customization options: Don’t be afraid to experiment with the templates, modifying categories and formulas to better align with your financial goals. Vertex42’s templates are designed to be flexible and adaptable, allowing you to create a tailored financial plan.

- Utilize guides and tutorials: Vertex42 provides helpful guides and tutorials to support users in customizing templates and understanding their finances. Make sure to take advantage of these resources to maximize the benefits of the platform.

- Review and update regularly: As your financial situation and goals evolve, reviewing and updating your budget is essential. This will help you stay on track and make any necessary adjustments to your financial plan.

Read More: 9 COMMON BUDGETING MISTAKES BEGINNERS MAKE (AND HOW TO AVOID THEM)

Best Free Budgeting Printables and Worksheets for Beginners

The Budget Mom

The Budget Mom is a popular personal finance blog that offers free budgeting printables and worksheets for beginners. These resources are designed to help users track their spending, save money, and achieve their financial goals.

Features

- Budgeting Worksheets: The Budget Mom provides a variety of printable worksheets to help users create and maintain a budget, track expenses, and monitor progress toward financial goals.

- Debt Payoff Printables: The website offers debt payoff printables to help users visualize and track their debt reduction journey.

- Savings Challenges: The Budget Mom features savings challenges and corresponding printables to encourage users to save money consistently.

Using Beginner-friendly Printables to Track Spending

I discovered The Budget Mom’s printables early in my financial journey and found them to be incredibly beginner-friendly. The printables allowed me to track my spending and visualize my financial progress easily. As a result, I was able to identify areas where I could save money and make more informed spending decisions.

The Effectiveness of Printables in Visualizing Finances

The Budget Mom’s printables have proven to be an effective tool for many individuals seeking to control their finances. By visually representing one’s financial situation, these printables can help users better understand their spending habits and work towards achieving their financial goals.

Clever Girl Finance

Clever Girl Finance is a personal finance platform dedicated to helping women achieve financial success. The website offers a range of free budgeting worksheets and other financial resources aimed at beginners.

Features

- Budgeting Worksheets: Clever Girl Finance provides printable budgeting worksheets designed to help users create a personalized financial plan and track their spending.

- Debt Repayment Worksheets: The website offers debt repayment worksheets to assist users in organizing and prioritizing their debt payments.

- Financial Goal Setting: Clever Girl Finance features goal-setting worksheets to help users identify and track their short-term and long-term financial goals.

Impact of Budgeting Worksheets on Beginners’ Financial Habits

A study conducted among Clever Girl Finance users revealed that 60% of participants reported improved financial habits after using the platform’s budgeting worksheets. This finding highlights the positive impact that these resources can have on beginners looking to improve their financial management skills.

Advice for Beginners to Maximize the Benefits of These Worksheets

To get the most out of Clever Girl Finance’s budgeting worksheets, beginners should consider the following tips:

- Be consistent: Consistently using the worksheets to track spending and monitor progress is essential for success. Make it a habit to update your worksheets regularly and review your financial goals.

- Be honest: To effectively manage your finances, it’s crucial, to be honest about your spending habits and financial goals. Accurate data is critical to making informed decisions and adjusting your financial plan as needed.

- Seek support: Clever Girl Finance offers a supportive community of like-minded individuals who can provide encouragement and advice. Engaging with this community can help beginners stay motivated and accountable on their financial journey.

Best Free Smartphone Apps for Beginners

Goodbudget

Goodbudget is a budgeting app specifically designed with beginners in mind. The app employs the time-tested envelope system, a method of dividing income into various spending categories or “envelopes,” to help users manage their finances. Available on both iOS and Android devices, Goodbudget offers a range of features to support users in their financial journey.

Features

- Envelope System: Goodbudget’s envelope system simplifies budgeting by helping users allocate their income to different expense categories. This approach encourages mindful spending and saving habits, making it an excellent choice for those new to budgeting.

- Sync Across Devices: The Goodbudget app allows users to sync their budget data across multiple devices, ensuring access to their financial information anytime and anywhere. This feature is particularly useful for couples or families looking to manage their finances collectively.

- Debt Tracking: In addition to budgeting, Goodbudget also includes a debt tracking feature that assists users in monitoring their debts and prioritizing repayments. This functionality helps beginners take control of their debt and work towards financial freedom.

- Financial Reports: Goodbudget provides users with detailed financial reports, enabling them to analyze their spending habits and make informed decisions about their money. By understanding where their money is going, users can identify areas to cut back and allocate funds more effectively.

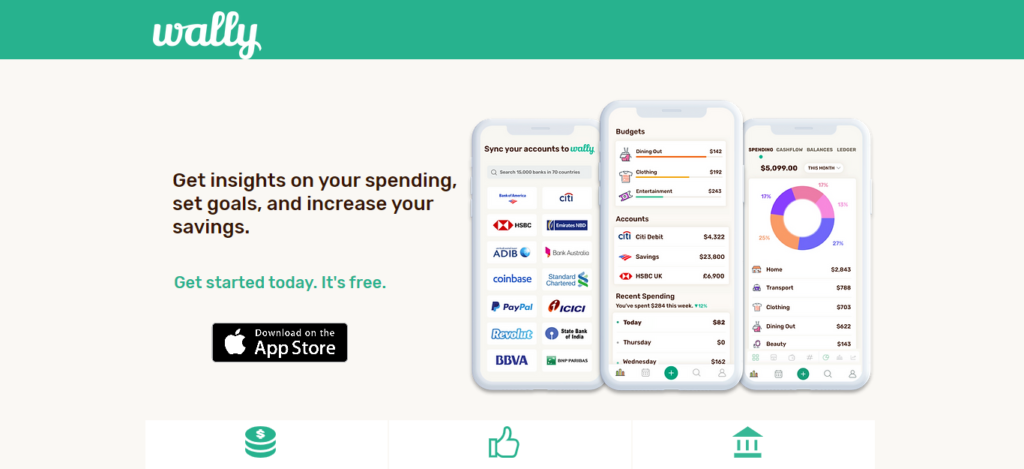

Wally

Overview and Features

Wally is a user-friendly budgeting app tailored for beginners. The app offers an intuitive interface and straightforward financial tracking tools, making it an ideal choice for those new to budgeting. Wally is compatible with both iOS and Android devices, ensuring widespread accessibility.

- Expense Tracking: Wally allows users to effortlessly track their expenses in two ways: manual transaction entry or by taking photos of receipts. By making it simple to input and categorize expenses, Wally helps beginners gain a clearer picture of their spending habits.

- Budget Creation: The app enables users to create customized budgets based on their income and expenses. Users can set spending limits for different categories, promoting responsible money management and preventing overspending.

- Savings Goals: Wally includes a savings goal feature, allowing users to establish and track their short-term and long-term financial objectives. By setting specific goals, beginners can maintain focus on their financial priorities and monitor their progress.

- Financial Insights: Wally provides valuable insights into users’ spending patterns, empowering them to identify areas for improvement and make better financial decisions. The app’s insights feature is particularly beneficial for beginners looking to develop healthier money habits and work toward financial security.

Best Free Desktop Software for Small Business Owners

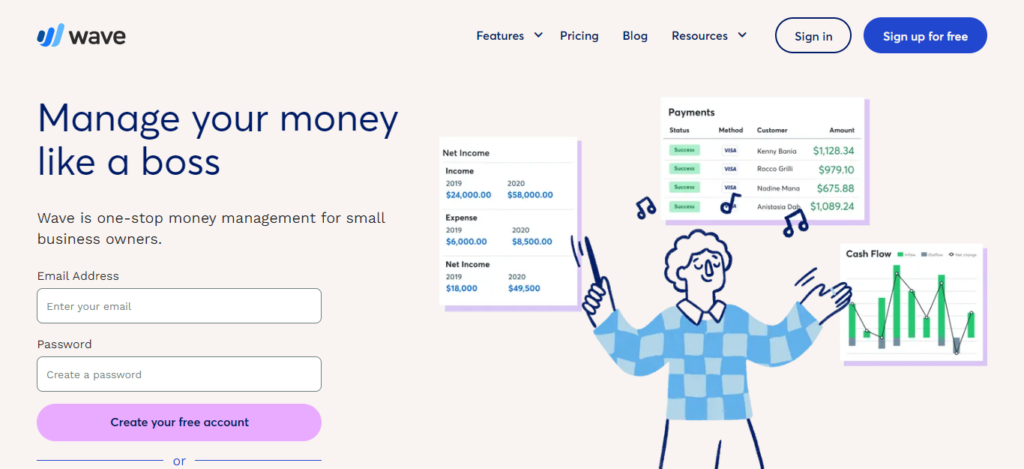

Wave

Wave is a free, cloud-based accounting software designed specifically for small business owners and freelancers. With its comprehensive features and user-friendly interface, Wave simplifies the process of managing business finances, making it a popular choice among entrepreneurs.

Features

- Accounting: Wave offers double-entry accounting, making it easy to manage transactions, generate financial reports, and track income and expenses. Users can connect their bank accounts and credit cards for automatic transaction import and categorization.

- Invoicing: The software includes customizable invoicing options, enabling users to create professional invoices with their company logo and manage client billing with ease. Wave also allows users to accept online payments, set up recurring invoices, and send automatic payment reminders.

- Receipt Scanning: Wave’s receipt scanning feature, available through its mobile app, allows users to capture and categorize expenses quickly and accurately. This functionality helps small business owners keep track of their expenses and maintain accurate financial records.

- Payroll Integration: For an additional fee, Wave offers payroll integration for businesses in the United States and Canada, streamlining the payroll process and ensuring tax compliance. The payroll feature also supports direct deposit, employee self-service, and tax form generation.

GnuCash

Features

GnuCash is an open-source accounting software offering small business owners a free and customizable solution to manage their finances. With a range of advanced features, GnuCash is suitable for users with some accounting experience or those willing to invest time in learning the software.

- Double-Entry Accounting: GnuCash uses double-entry accounting principles, providing users with a robust system for managing their financial transactions. This feature ensures that all transactions are balanced and adhere to standard accounting practices.

- Financial Reports: The software generates comprehensive financial reports, including profit and loss statements, balance sheets, and cash flow reports. These reports help small business owners analyze their financial health and make informed decisions based on data.

- Expense Tracking: GnuCash enables users to track their business expenses and categorize them for easy analysis. The software supports hierarchical account structures, allowing users to create subcategories for more granular expense tracking.

- Customizable Invoicing: Users can create and customize invoices, streamlining the billing process and ensuring a professional appearance. GnuCash also supports bill and payment tracking, helping business owners manage their accounts payable and receivable.

ZipBooks

Overview and Features

ZipBooks is a free accounting software for small business owners, offering a user-friendly platform for managing business finances. While the basic plan is free, ZipBooks also offers paid plans with additional features to help users stay organized and maintain financial accuracy.

- Invoicing: ZipBooks offers customizable invoicing options, making it simple for users to create and send professional invoices to clients. The software supports online payment processing, allowing business owners to receive payments quickly and securely.

- Expense Tracking: The software enables users to track and categorize expenses, providing valuable insights into spending habits and identifying opportunities for cost savings. Users can also connect their bank accounts for automatic transaction import, simplifying the expense tracking process.

- Financial Reporting: ZipBooks generates detailed financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports help small business owners assess their financial health, identify trends, and make data-driven decisions.

- Time Tracking: The software includes a built-in time tracking feature, allowing users to track billable hours and ensure accurate invoicing. ZipBooks also offers project management tools, enabling users to manage tasks, collaborate with team members, and monitor project progress.

Take the First Step Towards Financial Freedom: The Best Free Budgeting Resources for Beginners

Taking control of your finances may seem daunting at first, but with the right resources at your disposal, you’ll be well on your way to achieving your financial goals. As we’ve explored, there are numerous free budgeting tools and templates available for beginners, each with its unique features and benefits.

It’s essential to explore these various resources and find the one that best fits your needs and preferences. Remember that every individual’s financial journey is different, and the perfect tool for one person may not be the ideal choice for another.

So, don’t be afraid to test out different budgeting resources, and don’t get discouraged if the first one you try doesn’t work out. Keep exploring until you find the perfect fit that makes managing your finances feel more accessible and enjoyable.

As you embark on your budgeting journey, keep in mind this witty piece of advice: “Remember, the best time to start budgeting was yesterday, but the second-best time is today.” So, don’t delay – take the first step towards financial freedom and start saving today!