How to Plan for Inflation in Your Personal Finances

Inflation, the invisible pickpocket, stealthily chips away at the value of our hard-earned money. The need for practical advice on how to shield our personal finances from its effects becomes all the more essential. This article aims to provide you with actionable tips and strategies to protect your finances from inflation. We’ll explore topics such as adjusting your budget, investing in assets that outpace inflation, and building an emergency fund, all with a sprinkle of wit and personal experience.

Adjusting Your Budget: The Building Blocks of Financial Security

Just like maintaining a healthy diet, the foundation of financial security lies in managing your budget. When the cost of living creeps up due to inflation, it’s crucial to reevaluate and adjust your budget accordingly.

I still remember the day I realized my budget needed an inflationary makeover. After seeing my grocery bill skyrocket over just a few months, I knew it was time to take action.

Here are a few practical tips to help you adjust your budget for inflation:

- Track your expenses: Keep a close eye on your spending patterns and identify areas where you can cut back or allocate more funds.

- Update your budget categories: Regularly review and update the amounts allocated to each budget category to reflect current prices.

- Be flexible: Don’t be afraid to make changes as needed. Your budget should be treated like a rubber band, with the ability to stretch and contract in response to economic fluctuations.

By proactively adjusting your budget, you’ll be better prepared to weather the storm of inflation and maintain your financial security.

The Golden Goose: Investing in Assets that Outpace Inflation

In the quest for financial stability, we often seek a golden goose—an investment that can outpace inflation and safeguard our money’s purchasing power. Historically, assets such as stocks, real estate, and precious metals have proven to be effective inflation fighters.

I once hesitated to invest in stocks, fearing the risks. But after careful research and taking the plunge, I’ve seen my investments grow over time, outpacing inflation and allowing me to reap the rewards.

However, it’s important to remember that not all investments are created equal. Traditional savings accounts, for example, typically offer interest rates below inflation, causing your money to lose value over time.

Diversification and long-term investing are key to success in this arena. By spreading your investments across various asset classes, you’ll be better prepared for whatever the economy throws your way.

Your Financial Umbrella: Building an Emergency Fund

Life has a way of throwing curveballs when we least expect them. A sturdy emergency fund, or “financial armor,” can provide a shield against unexpected expenses and help you maintain financial stability during inflationary times.

I recall a time when my car broke down, and the repair costs were astronomical. Thanks to my emergency fund, I was able to cover the expenses without derailing my financial goals.

Here are some tips to help you build your own financial armor:

- Set a target: Aim to save 3-6 months’ worth of living expenses as a starting point.

- Automate contributions: Set up automatic transfers to your emergency fund from your paycheck or checking account.

- Keep it separate: Store your emergency fund in a separate, easily accessible account to avoid the temptation to dip into it for everyday expenses.

By building a robust emergency fund, you’ll be better equipped to handle financial surprises and stay on track, even during times of inflation.

The Informed Investor: Staying Up-to-Date with Economic Trends

As the saying goes, knowledge is power. Staying informed about economic trends is essential for making sound financial decisions and effectively managing the impact of inflation on your personal finances.

There are numerous sources of information to choose from, including news outlets like CNBC or Bloomberg, financial blogs such as The Balance or Investopedia, and podcasts like Planet Money or The Indicator from Planet Money.

I once made a timely decision to adjust my investment portfolio after learning about a shift in economic trends through a podcast. This move saved me from potential losses and reinforced the importance of staying informed.

It’s essential to engage regularly with these sources, not just for one-time learning but also for ongoing financial education.

The Annual Financial Check-up: Regularly Reviewing Your Financial Plan

“Don’t stagnate; reevaluate!” Just like a doctor’s check-up, it’s important to periodically review and adjust your financial plan to ensure it remains effective in the face of inflation and other economic changes.

I recall a time when I realized my financial goals needed to be adjusted to account for inflation. This epiphany led me to revisit my plan and make the necessary changes to stay on track.

Here are some practical tips for reviewing and updating your financial plan:

By regularly reviewing your financial plan, you’ll be better equipped to adapt to economic changes and stay on the path to financial success.

Above and Beyond: Additional Strategies for Financial Success

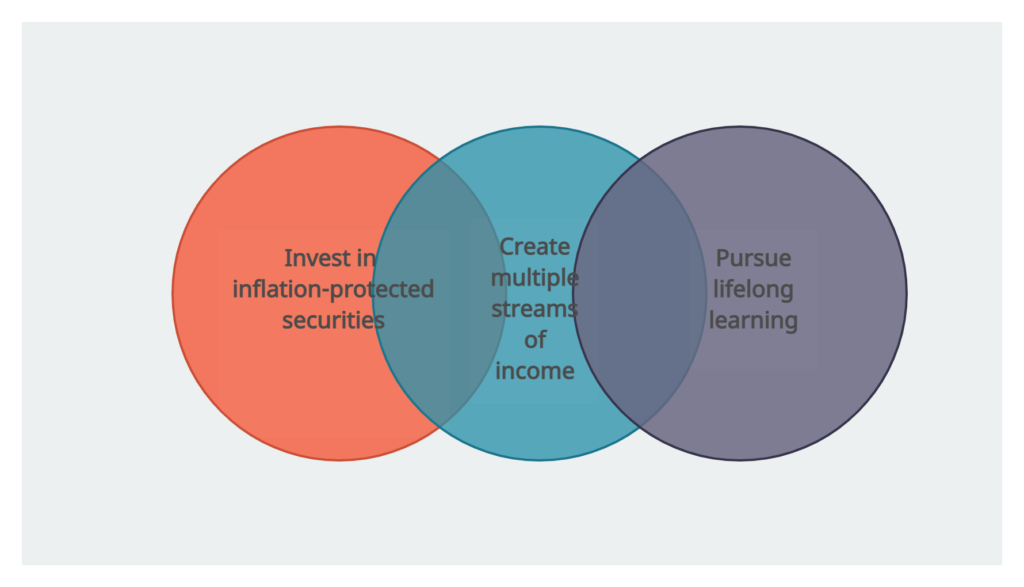

For those who are eager to go the extra mile in the battle against inflation, consider these lesser-known strategies to further bolster your financial position:

- Invest in inflation-protected securities: Treasury Inflation-Protected Securities (TIPS) are government-issued bonds that adjust with inflation. You can learn more about TIPS from the U.S. Department of the Treasury.

- Create multiple streams of income: Diversify your income sources by exploring side hustles, freelance work, or passive income streams. Check out this article for ideas on generating multiple income streams.

- Pursue lifelong learning: Continuously update your skills and knowledge to remain competitive in the job market. Websites like Coursera or LinkedIn Learning offer a wealth of courses to enhance your career prospects.

By embracing these strategies, you’re not only combating inflation but also going above and beyond to achieve financial success.

Conclusion

Inflation may be an unavoidable part of life, but that doesn’t mean we can’t take steps to protect our personal finances. By adjusting your budget, investing in assets that outpace inflation, building an emergency fund, staying informed about economic trends, regularly reviewing your financial plan, and exploring additional strategies, you can stay ahead of the game.

Don’t wait for the invisible pickpocket to strike. Take action now and apply the advice provided to ensure your financial success, even in the face of inflation. With a little planning and perseverance, you can be well on your way to achieving your financial dreams.